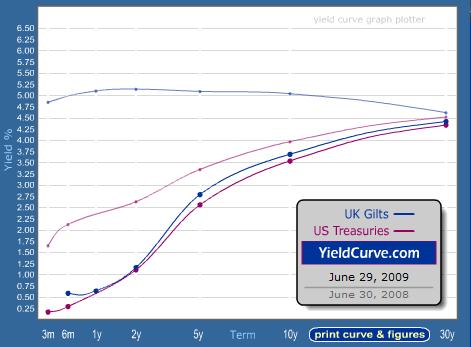

For those of you that make a living (i.e. trade forex) from interest rate differentials, consider that the US Treasury yield curve is now steeper than at any point in recent memory. Short-term rates are still close to zero, while long-term rates just passed 4% and are still rising. The theoretical implication is that one can borrow at a low short-term rate and reinvest at a higher long-term yield. The question is: would you want to?

The meeting this week of the Federal Reserve Bank yielded few surprises, as the Fed voted to hold its benchmark Federal Funds Rate at the current level of nil, and indicated that they would stay “unusually low” for the near-term. According to one analyst, “It was totally as expected. The market doesn’t seem to have reacted that much. Everybody pretty much knew that for sure they wouldn’t raise rates anytime soon and they wouldn’t do anything to withdraw liquidity.”

At the same time, the Fed voted to maintain (though not to increase) its $1.75 Trillion asset price program, in order to prevent long-term rates from rising. This was probably directed at mortgage rates, which had begun to move higher in recent weeks, leading some analysts to fear that the nascent economic recovery would be stillborn. However, “Part of the rise in rates may be caused by fears that the Fed will allow inflation to get out of control down the road and that it will print money to finance government deficits. To the degree that those fears are out there, expansion of the Fed programs could be counterproductive, sending rates up rather than down.” In other words, the Fed is naive in its assumption that it can buy rates down, since its very act of buying is actually sending rates up!

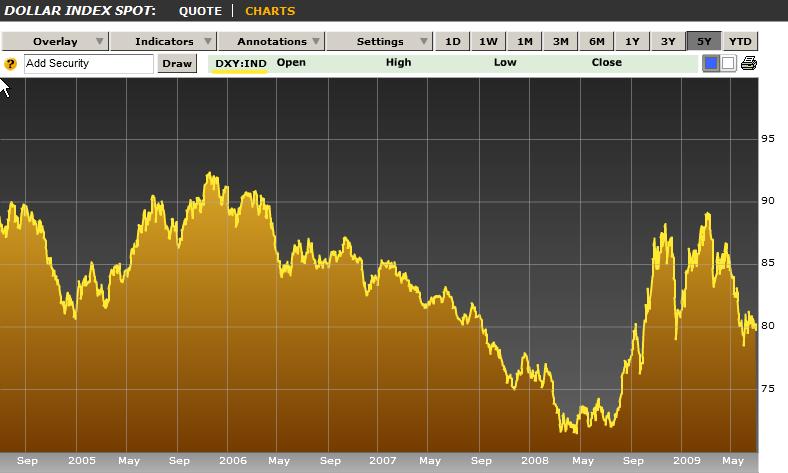

This could be very bad for the US Dollar, which loses on both ends of the curve. Low short-term rates make it cheap to use the Dollar as a funding currency, while high long-term rates imply the expectation of inflation, and thus capital erosion. Current market conditions are unique, however: “The enthusiasm of the past three months has led many to believe that the Fed has actually provided more than adequate liquidity…It is critically important to remember that the dollar is the funding currency whose availability, or lack of … will drive all the markets in the world,” said one analyst.

This, the lack of liquidity in credit markets (the very problem that the Fed is trying to counter) is actually good for the Dollar, since it implies an under-supply. On the other hand, if the Fed is “successful” in its asset purchase program, then the supply of Dollars must necessarily increase relative to the demand, in which case the Dollar will fall. It’s not as cut-and-dried as it was prior to the credit crisis, but interest rate differentials (both short and long-term) still hold represent one of the crucial determinants of exchange rates.